you have complete control over how you provide service to the business or organization that is paying you.the business or organization gives you a Form 1099 rather than a Form W-2, or Youre allowed to use either the actual costs you incurred, in which case you should save your receipts, or the standard daily meals and incidental expenses.

This includes the costs of your own vehicle, supplies or equipment you are responsible for your own costs associated with the service provided.you create your own schedule and hours.As a self employed individual, you are required. the business or organization controls how a job is performed. If you work on your own and you are not an employee, you will pay taxes a little differently than employees do.the business or organization considers you an employee, or.

Independent contractor expenses when receipt needed free#

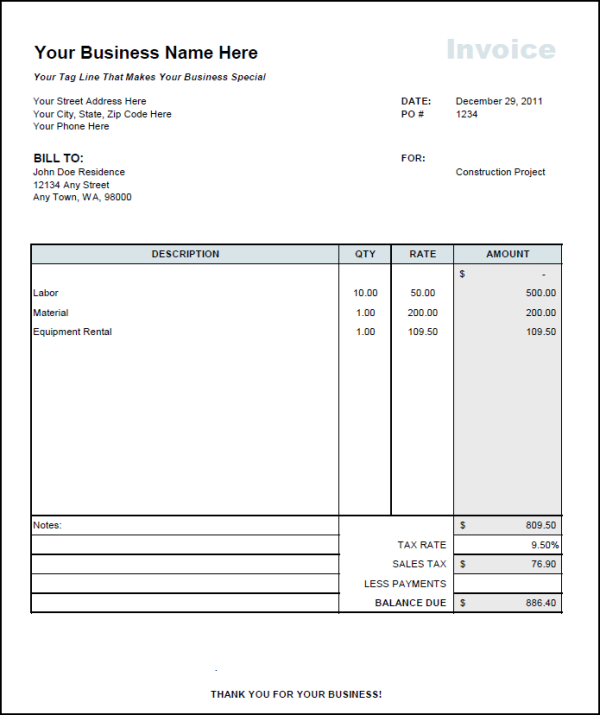

This free receipt is provided to a customer to properly state and present the materials and necessary things needed to get the job finished and how much it would cost. It could vary from different things like building material, prices, and labor costs.

Furthermore, it is beneficial while filling out 1099-misc forms. Keep in mind that you will need to have receipts to support these expenses. Use a 1099 spreadsheet template (Excel or google sheets) Perhaps the best way to track your income and business expense as an independent contractor is through spreadsheets. The IRS offers the following criteria as general guidelines. This number is based on the percentage of time you use the vehicle for driving. Travel expenses for nonresidents are considered taxable income unless receipts. We accept the determination of the Internal Revenue Service regarding your status as an independent contractor or an employee. The nonresident independent contractor will be required to complete the. In New Mexico, pay received by independent contractors is subject to gross receipts tax unless a statutory exemption or deduction applies to a transaction.Įmployee wages are exempt from gross receipts tax.

You cannot be both for purposes of a single transaction. If you provide services for one or more businesses or organizations, you are considered either an employee or independent contractor. Unlike employees, who have taxes withheld out of every paycheck, independent contractors may need to withhold taxes on their own income or use their own.

0 kommentar(er)

0 kommentar(er)